Texas title loans with liens involve lenders placing a legal claim on a borrower's vehicle as collateral, impacting loan terms like LTV ratios, interest rates, and inspection requirements. Borrowers should understand liens restrict asset disposal until loan repayment and consider how existing encumbrances, such as tax liens or judgments, affect their borrowing capacity by lowering the property's value, potentially limiting loan amounts. To secure favorable terms, borrowers should assess financial standing, pay off existing liens, explore alternative financing options, or consider no credit check lenders based on their criteria.

In the competitive landscape of Texas, understanding the impact of liens on title loans is crucial for borrowers and lenders alike. This article delves into the intricate relationship between liens and the loan-to-value (LTV) ratio in Texas title loans. We’ll explore how these legal claims affect financing decisions, break down the calculation process, and provide strategies to mitigate the effects of liens. By understanding these dynamics, borrowers can make informed choices and lenders can optimize their risk management.

- Understanding Texas Title Loan Liens

- Impact on Loan-to-Value Ratio Calculation

- Strategies to Mitigate Lien Effects

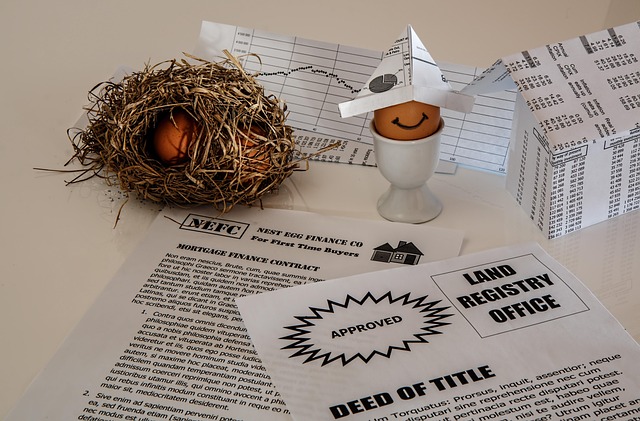

Understanding Texas Title Loan Liens

In Texas, a title loan is a short-term financing option secured by an individual’s vehicle. Understanding the implications of liens on such loans is crucial for borrowers in the state. When a borrower takes out a Texas title loan with liens, it means that the lender has placed a legal claim on the borrower’s vehicle as collateral. This lien serves as protection for the lender in case the borrower defaults on repaying the loan. Liens can be imposed by various entities, including financial institutions and government agencies, and they play a significant role in determining the loan-to-value (LTV) ratio.

The presence of liens on a vehicle significantly impacts the Loan Terms associated with a Texas title loan. Lenders will assess the value of the collateral—in this case, the vehicle—and compare it to the outstanding loan amount to establish the LTV ratio. A higher LTV ratio may result in stricter Interest Rates and more stringent requirements for Vehicle Inspection to mitigate risk. Borrowers should be aware that liens can limit their ability to sell or dispose of the secured asset without fulfilling the loan obligations, ensuring a clear title transfer upon repayment.

Impact on Loan-to-Value Ratio Calculation

When considering a Texas title loan with liens, it’s crucial to understand how these encumbrances impact the loan-to-value (LTV) ratio calculation. Liens, such as tax liens or judgments, are claims against the value of a property and are taken into account when determining the maximum loan amount. In simple terms, they reduce the available equity that can be borrowed against the asset.

For instance, if an individual has a car with a market value of $10,000 and existing liens totaling $2,000, the lender will base the loan-to-value ratio on the net value after these liens are subtracted. This scenario might limit the potential loan amount for emergency funds or other financial needs, as lenders typically aim to maintain a safe LTV range to mitigate risk, especially in cases where loan refinancing could become necessary in the future.

Strategies to Mitigate Lien Effects

When it comes to Texas title loans with liens, understanding how these encumbrances impact your loan-to-value ratio (LTV) is key. Liens can significantly lower the value of a vehicle, thus increasing the LTV and potentially making it harder to secure favorable loan terms. To mitigate these effects, borrowers should consider proactive strategies. One effective approach is to pay off any existing liens before applying for a Texas title loan. Clearing liens not only improves your LTV but also demonstrates to lenders that you’re committed to managing your debt responsibly.

Additionally, exploring alternative financing options like semi truck loans or considering lenders who offer no credit check can be beneficial if you meet their specific criteria. Assessing your financial situation and understanding the Loan Requirements of different types of loans will help in choosing the best path forward. Remember, a well-informed decision can make a significant difference in managing liens’ impact on your Texas title loan LTV.

In conclusion, understanding how Texas title loan liens impact the loan-to-value ratio is crucial for borrowers and lenders alike. By grasping the effects of these legal claims on property valuation, individuals can employ strategies to mitigate risks and optimize their financing options. Awareness and proactive management of liens are key to navigating the complex landscape of Texas title loans effectively.