A Texas title loan with liens offers short-term vehicle-secured financing but carries risks of repossession and high interest rates. Borrowers must understand lender terms, manage financial strain through timely payments, and initiate lien removal upon successful payoff to protect their asset and maintain credit standing. Direct deposit options streamline repayment for a clear, structured process.

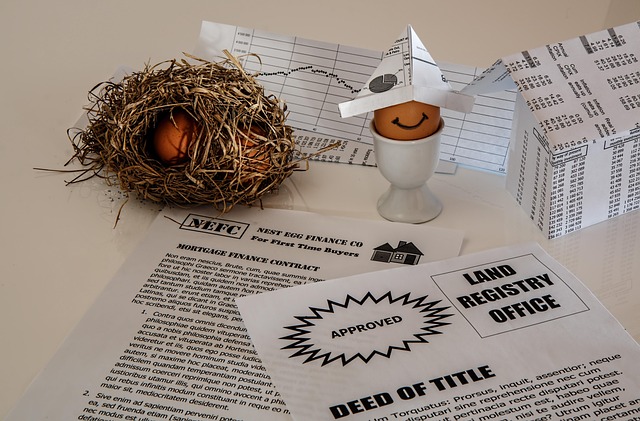

In the state of Texas, understanding the intricacies of a title loan with liens is crucial for borrowers seeking quick cash. This comprehensive guide delves into the specifics of Texas title loans with liens, shedding light on their implications and the rights of borrowers. We explore how these loans work, the potential risks involved, and provide an insightful look at the repayment process, including lien removal options. By understanding these aspects, borrowers can make informed decisions and navigate this financial tool wisely.

- Understanding Texas Title Loans With Liens

- Implications for Borrowers: Rights and Risks

- Navigating Repayment and Lien Removal Process

Understanding Texas Title Loans With Liens

In Texas, a title loan with liens is a specific type of short-term financing secured by the borrower’s vehicle. This means that the lender places a lien on the vehicle’s title, giving them legal claim over the asset until the loan is fully repaid. Understanding this arrangement is crucial for borrowers seeking emergency funds through such loans. It’s important to know that while this option can provide quick access to cash, it comes with significant implications.

If you opt for a Texas title loan with liens, your vehicle will serve as collateral, ensuring the lender’s investment. However, if you fail to repay the loan according to the agreed-upon terms, including timely interest payments, the lender has the right to repossess your vehicle. This process can impact your ability to access emergency funds through loan refinancing in the future, as it leaves a mark on your credit history due to the lien and repossession. Additionally, high interest rates associated with these loans should be carefully considered before borrowing.

Implications for Borrowers: Rights and Risks

When taking out a Texas title loan with liens, borrowers must be aware of both their rights and potential risks. A title loan secured by a lien on your vehicle allows lenders to seize and sell your car if you fail to repay the loan according to the agreed-upon terms. This means that even though you retain possession of your vehicle during the loan period, there’s a significant risk involved.

Borrowers have the right to understand the full scope of the loan agreement, including interest rates, late fees, and any additional charges. It’s crucial to carefully consider your financial situation and ability to repay the loan promptly to avoid losing your asset. Keeping Your Vehicle is possible if you adhere to the loan terms, making timely payments can help protect your investment and ensure you retain ownership of your vehicle throughout the entire process. Bad Credit Loans can be attractive due to lax credit checks, but these loans often come with shorter Loan Terms and higher interest rates that can exacerbate financial strain.

Navigating Repayment and Lien Removal Process

Navigating the repayment process for a Texas title loan with liens involves understanding the terms set forth by the lender. Borrowers must adhere to the loan agreement, which outlines the schedule and method of repayment. Typically, this includes regular installment payments over a defined period until the full balance is settled. Upon successful loan payoff, borrowers can initiate the lien removal process. This involves submitting necessary documentation to the Texas Department of Motor Vehicles (DMV) to have the lien recorded for deletion from their vehicle’s title.

For those concerned about their credit standing, it’s important to note that while a title loan with liens can impact one’s financial profile, it may not necessarily hinder future access to Bad Credit Loans. Once the loan is repaid and the lien removed, individuals can rebuild their creditworthiness through responsible financial management, including timely bill payments and maintaining low debt-to-income ratios. Additionally, direct deposit options offered by some lenders can facilitate efficient Loan Payoff, ensuring borrowers have a clear and structured repayment path.

A Texas title loan with liens can provide quick cash but comes with significant risks. Borrowers must be aware of their rights and the potential consequences, including repossession if unable to repay. Understanding the repayment process and lien removal is crucial for mitigating these risks. Educated borrowers can navigate this option more safely, ensuring they retain ownership of their assets while accessing much-needed funds.