In Texas, a Texas title loan with liens offers quick cash using one's vehicle title as collateral, without strict credit checks. With easy online applications and straightforward terms, it's a short-term solution but requires understanding interest rates and repayment conditions that vary by lender. To avoid financial strain, borrowers can restructure their loans by assessing their situation, negotiating with lenders for more manageable payments (e.g., extended terms or new budgets), and prioritizing asset protection to maintain control over their vehicles while making adjustments.

In the state of Texas, understanding the intricacies of a title loan with liens is crucial for borrowers seeking financial solutions. This article guides you through the process of managing these loans, focusing on restructuring payment plans. Learn how to navigate the options available and devise strategies tailored to your situation. Additionally, discover the steps involved in protecting your assets during the restructuring process, ensuring a clearer path toward financial stability. Explore the comprehensive guide to Texas title loan with liens restructuring.

- Understanding Texas Title Loans and Liens

- Restructuring Payment Plans: Options and Strategies

- Protecting Your Assets: What to Expect During the Process

Understanding Texas Title Loans and Liens

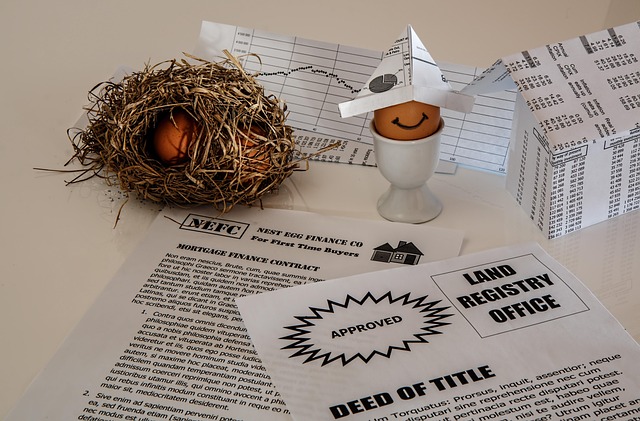

In Texas, a title loan with liens is a type of secured lending where individuals use their vehicle’s title as collateral to borrow money. This option is popular among those seeking quick cash access with minimal requirements, often not needing a credit check. Liens serve as legal claims on the borrower’s asset (in this case, the vehicle) until the loan is repaid in full. Understanding these loans and liens is crucial when considering their potential benefits and drawbacks.

Texas title loans, also known as title pawns, offer a straightforward process with an online application, allowing borrowers to complete transactions without extensive paperwork or waiting times. However, it’s essential to be aware of the terms and conditions, including interest rates and repayment periods, which can vary among lenders. With proper planning and timely repayments, these loans can provide a reliable short-term financial solution for folks in need.

Restructuring Payment Plans: Options and Strategies

When facing a Texas title loan with liens, restructuring your payment plans can offer much-needed relief and a way to regain control of your finances. The first step is to assess your current financial situation and understand the terms of your loan agreement. This involves reviewing the original title loan process, interest rates, and repayment terms offered by the lender. Many lenders are willing to work with borrowers who are committed to repaying their loans but need adjustments to make payments more manageable.

Options for restructuring include extending the loan term, which can lower monthly payments but may result in paying more interest overall. Another strategy is to negotiate a new payment plan that aligns with your budget, possibly involving increased monthly payments once you’ve resolved any lien issues. Some lenders provide repayment options like repayment schedules tailored to specific needs or even the possibility of settling the loan early without penalties. Choosing the right approach depends on your unique circumstances and the willingness of the lender to accommodate.

Protecting Your Assets: What to Expect During the Process

When dealing with a Texas title loan that includes liens, protecting your assets is paramount during the restructuring process. This means understanding the nature of secured loans and their impact on your property rights. During negotiations, expect discussions around loan eligibility criteria, which can vary based on factors like vehicle condition, income levels, and outstanding debt. The goal is to find a financial solution that allows you to maintain control over your assets while making manageable payment adjustments.

Secured loans, by their nature, require collateral, often in the form of your vehicle’s title. Restructuring involves reevaluating this collateral and potentially modifying the terms to align with your current financial situation. This can be a delicate balance, as it aims to provide relief without compromising the lender’s interest. By understanding these dynamics, borrowers can navigate the process more effectively, ensuring they remain in control of their assets while exploring viable financial solutions.

When faced with a Texas title loan with liens, restructuring your payment plan can offer much-needed relief. By exploring various options and strategies, you can gain control over your financial situation and protect your assets. Remember, proactive measures during this process are key to ensuring a smoother journey towards repayment and preserving your future financial stability.