Texas title loans secured by vehicle titles offer quick funding but require understanding of existing liens on the vehicle, including car loans and tax liabilities, impacting loan amounts. Lenders thoroughly assess borrowers' financial health and vehicle condition, distinguishing from riskier alternatives like Boat Title Loans or Cash Advances. Defaulting can lead to repossession, with lenders valuing vehicles to pursue repayment if terms are not met. Debt consolidation and financial assistance options may simplify repayment and fund lien removal.

In Texas, individuals often turn to title loans as a quick financial solution. However, existing liens on vehicles can complicate matters. This article explores the intricate world of Texas title loans with existing liens, offering insights into their legal aspects and available management strategies. Understanding these options is crucial for borrowers, as it allows them to make informed decisions regarding their vehicle’s security. We’ll discuss legal implications and provide practical strategies to navigate and potentially remove liens.

- Understanding Texas Title Loans and Existing Liens

- Legal Implications of Taking Out a Loan With Liens

- Strategies to Manage and Remove Liens on Your Vehicle

Understanding Texas Title Loans and Existing Liens

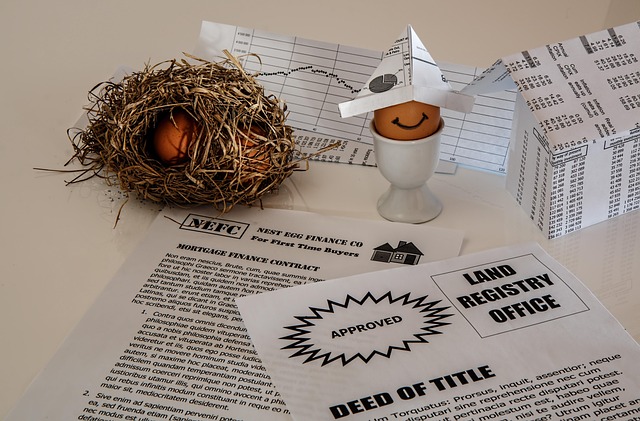

Texas title loans are a form of secured lending where individuals can borrow money by using their vehicle’s title as collateral. This type of loan is popular in Texas due to its flexible requirements and relatively quick funding process, making it an attractive option for those needing immediate financial assistance. However, understanding that these loans are secured against the vehicle’s title means there can be existing liens on the vehicle.

Existing liens refer to any outstanding debts or claims on a vehicle, such as outstanding car loans, lease agreements, or even tax liabilities. When considering a Texas title loan with liens, lenders will assess the value of the vehicle and the remaining balance on any current liens. Despite the term “no credit check,” lenders still verify the borrower’s financial health by reviewing their credit history and the status of the vehicle’s title. This process ensures that the lender has a secure investment, especially when compared to alternative options like Boat Title Loans or Cash Advances, which often carry higher-risk profiles due to less stringent requirements.

Legal Implications of Taking Out a Loan With Liens

When considering a Texas title loan with existing liens, it’s paramount to understand the legal implications involved. Taking out a loan using your vehicle as collateral can have significant consequences if not managed properly. If you already have outstanding loans or liens on your vehicle, lenders will assess the value of your vehicle and the remaining balance on the current liens to determine the maximum amount they are willing to lend. This process is crucial as it ensures fair lending practices while mitigating financial risks for both parties.

In Texas, as with most states, defaulting on a loan with a lien on your vehicle can lead to repossession. Additionally, the lender’s rights to the collateral are legally secured, which means they have the authority to sell the vehicle if you fail to repay the loan according to the agreed-upon terms. The vehicle valuation process is a critical step in this equation, as it dictates the amount of money at stake and can impact how aggressively the lender will pursue repayment. Even in cases where a Dallas title loan might seem like a quick solution, borrowers must be aware that their vehicles are at risk if they cannot keep up with the loan payments.

Strategies to Manage and Remove Liens on Your Vehicle

When dealing with a Texas title loan while having existing liens on your vehicle, managing and potentially removing these liens becomes essential. One effective strategy to consider is debt consolidation, which involves combining multiple debts into a single, often lower-interest loan. This can simplify your repayment process and free up funds for addressing the vehicle liens. Financial assistance from trusted sources, such as non-profit organizations or government programs, might also be available to help with lien removal costs, especially if the liens are due to unforeseen circumstances like medical bills or unexpected repairs.

Understanding loan requirements is crucial in this scenario. Lenders often require clear title ownership when providing a Texas title loan. If your vehicle has existing liens, you may need to pay off these debts before applying for another loan. Alternatively, some lenders might be open to working with you on a repayment plan that includes lien removal as part of the agreement, ensuring you maintain control over your vehicle while managing your financial obligations effectively.

When considering a Texas title loan with existing liens, it’s crucial to understand both the financial benefits and legal complexities. While these loans can offer quick access to cash, understanding the potential implications on your vehicle’s ownership is essential. By exploring strategies to manage and, if possible, remove liens, you can navigate this option more confidently. Remember, proactive management of your vehicle’s title ensures you retain full control and accessibility in the long term.